montgomery county al sales tax

Montgomery is located within Montgomery County. The current total local sales tax rate in Montgomery County AL is 6500.

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

As for zip codes there are around 36 of them.

. Has impacted many state nexus laws and sales tax collection. AL Sales Tax Rate. Montgomery AL 36104-1667 334 832-1250.

This is the total of state county and city sales tax rates. The Montgomery County Sales Tax is 25. The average cumulative sales tax rate in Montgomery Alabama is 10.

A full list of these can be found below. 6 rows The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales. The tax is collected by the seller.

The Food Service Establishment Tax is a five percent 5 sales tax levied in lieu of the five 5 general sales tax on the gross proceeds of sales at retail of food andor beverages. You can print a. This includes the rates on the state county city and special levels.

CITIZEN ACCESS PORTAL. Combined Application for SalesUse Tax Form. The current total local sales tax rate in Montgomery AL.

Sales tax is a privilege tax imposed on the retail sale of tangible personal property sold in Alabama by businesses located in Alabama. SalesSellers UseConsumers Use Tax Form. The 10 sales tax rate in Montgomery consists of 4 Alabama state sales tax 25 Montgomery County sales tax and 35 Montgomery tax.

The minimum combined 2022 sales tax rate for Montgomery Alabama is. Montgomery County is located in Alabama and contains around 10 cities towns and other locations. What is the sales tax rate in Montgomery Alabama.

Spear Montgomery County Revenue Commissioner PO. If you need access to a database of all Alabama local sales tax rates visit the sales tax data page. Montgomery County Archives MCA is helping to create a digital database intended to give a global audience greater access to legal records identifying victims of slavery.

Combined Application for SalesUse Tax Form. 4 rows Montgomery. A county-wide sales tax rate of 25 is applicable to localities in Montgomery County in addition to the 4 Alabama sales tax.

Walk-in filing may be done at the following locations. There is no applicable special tax. The Montgomery County sales tax rate is.

County SalesUse Tax co Sarah G. The Montgomery County Alabama tax sale is held at 1000 AM in front of the Montgomery County Courthouse during the months of April and May of each year. The 2018 United States Supreme Court decision in South Dakota v.

Box 4779 Montgomery AL 36103-4779. The December 2020 total local sales tax rate was also 6500.

Sales Taxes In The United States Wikiwand

Alabama Sales Tax Guide For Businesses

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

Texas Car Sales Tax Everything You Need To Know

Alabama S Back To School Sales Tax Holiday Is This Weekend

Alabama Shoppers To Enjoy Back To School Sales Tax Holiday July 15 17 Alabama Newscenter

Ouch Alabama Has 4th Highest Combined Sales Tax Rate In The Country Yellowhammer News

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

Pennsylvania Sales Tax Small Business Guide Truic

Chicago Il Sales Tax Shop 54 Off Www Ingeniovirtual Com

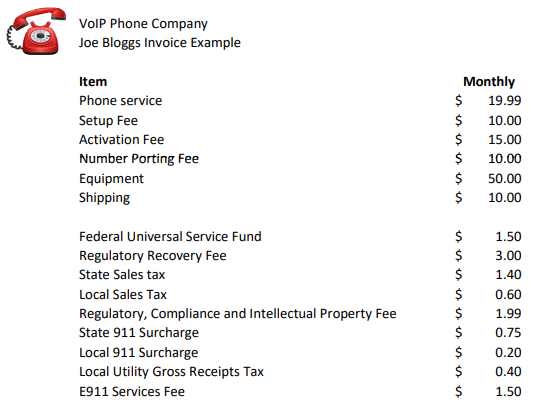

Voip Pricing Taxes And Regulatory Fees Explained

Alabama Sales Use Tax Guide Avalara

Chicago Now Home To The Nation S Highest Sales Tax Sales Tax Chicago Tax

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

File Sales Tax By County Webp Wikimedia Commons

Sales Taxes In The United States Wikiwand

Sales Tax Audit Montgomery County Al